Key Scenarios Where Reverse Charge Applies in UAE

01

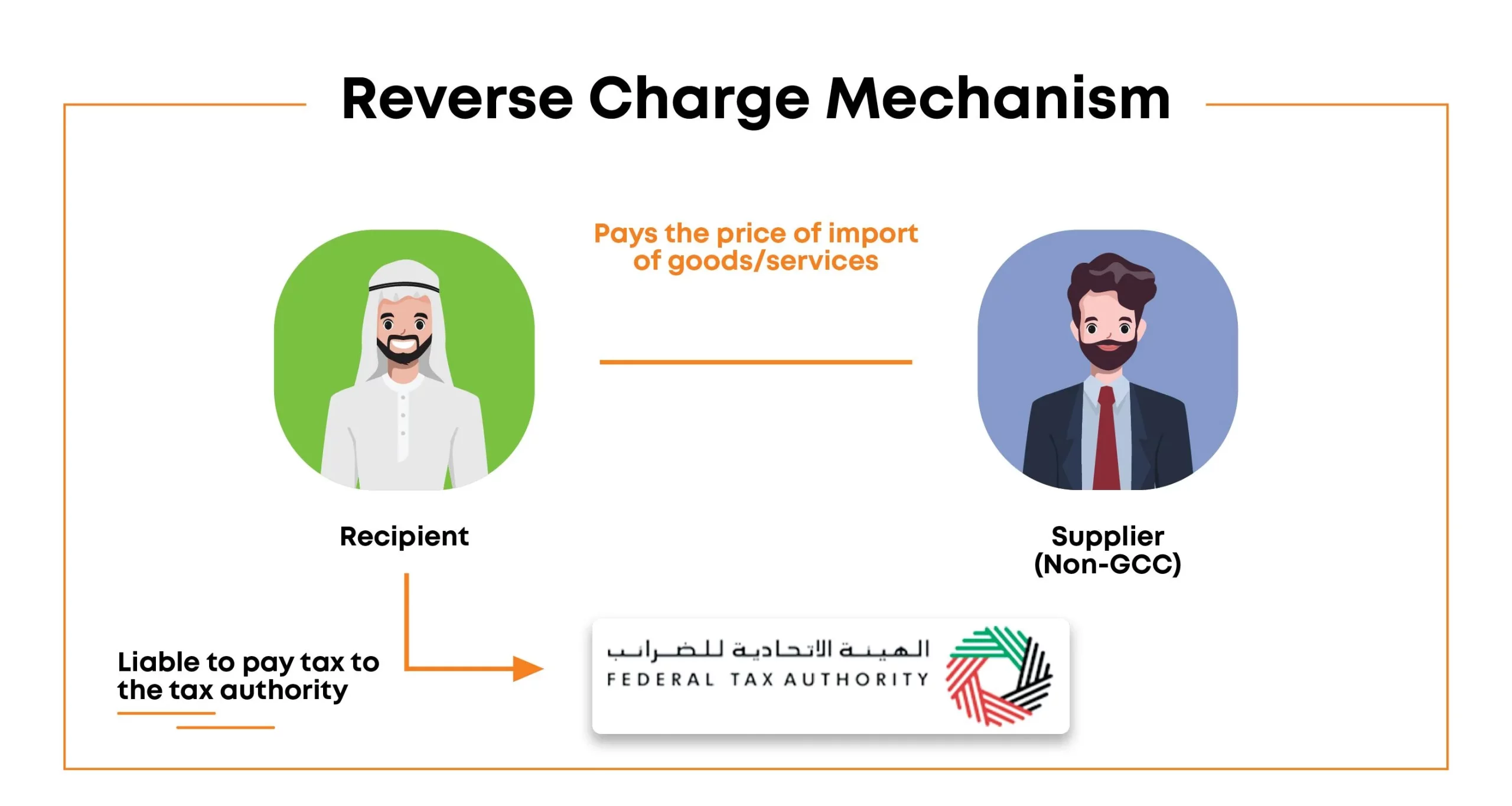

Import of goods and services

The UAE imports services and goods and this is when the reverse charge mechanism really comes into play. The process is quite clear: When a UAE enterprise imports services from suppliers abroad, it is necessary for them to pay VAT from their own pocket instead of having a foreign supplier collect it.

Moreover, in the case of imported goods, the reverse charge is directly linked to the procedures that UAE Customs specialize in. This means that the consignee after clearing the goods from the customs becomes a VAT return preparer who notes both the output and input tax accordingly.

What else makes this system particularly advantageous? It eliminates the waiting period of filing and refunding VAT, that is, the taxpayer is simultaneously settling and recovering the VAT within the same filing. So, there’s no need for prepayment of VAT and no lengthy process for a refund.

For example: A customer hires a firm in the UK to provide business advisory services valued at AED 100,000. Said firm, instead of charging the Dubai company with 5% VAT, the Dubai company declares its AED 5,000 VAT on their return.

Domestic transactions between UAE businesses

Within the UAE, the reverse charge is applicable to certain business-to-business transactions. Such cases usually pertain to gold, diamonds, and other precious metals. Starting January 2018, the situation when a UAE business that sells these precious goods to another business in the UAE, the business which received the goods, not the vendor, has to report the VAT, was introduced. This was designed in order not to cause liquidity problems in the given country’s industry with a large number of high-value transactions. While the supply of crude or refined oil, natural gas, and other hydrocarbons to the domestic market is the second most typical case. The two sectors have their own set of rules for the reverse charge type and despite these rules, they still respect both the tax regulations and the market. The overall idea of the system is to avoid market defaults and extract the taxes of the high-value sectors. It should be mentioned that the buyers and the sellers need to be VAT-registered for the domestic reverse charge to be valid.Designated zones and free zone transactions

Free zones and designated zones in the UAE present interesting reverse charge scenarios. These areas are designed as “outside the UAE” for VAT purposes, but with some exceptions.When goods move from a designated zone to mainland UAE, the recipient typically applies the reverse charge. This creates a simplified tax collection system while maintaining the tax advantages these zones offer.

For services provided by businesses in designated zones to mainland companies, the recipient must self-account for VAT if the services are consumed in mainland UAE. The rules get more complex when dealing with transactions between different designated zones. Generally, such movements don’t trigger VAT obligations unless the goods are actually consumed within the zone.

This strategic approach allows the UAE to maintain its attractive free zone benefits while ensuring the VAT system remains intact. Businesses operating across these boundaries need robust systems to track where consumption actually occurs.

Real estate and construction industry applications

The construction sector has specific reverse charge provisions that help manage cash flow on major projects. For certain specified services like contracting and consultant services related to real estate, the recipient can be required to account for VAT.This is particularly relevant for government entities involved in infrastructure projects. When a private contractor provides construction services to a government entity, the reverse charge mechanism may apply, allowing the government to self-account for VAT.

Commercial real estate transactions between VAT-registered businesses can also fall under reverse charge in specific circumstances, especially for bare land transactions or buildings sold as investment properties. The benefits are huge for construction companies working on large-scale projects—no need to finance VAT payments while waiting for client payments, which improves cash flow significantly on projects that often run into millions of dirhams.

Oil and gas sector specific scenarios

The oil and gas industry gets special reverse charge treatment due to its economic importance to the UAE. When oil field services are provided by foreign companies to UAE operators, the reverse charge typically applies.For domestic supplies between UAE businesses in this sector, special provisions allow for reverse charge on specific categories of goods and services unique to the industry, such as drilling equipment, specialized technical services, and seismic surveys.

Upstream activities (exploration and production) often have different reverse charge rules compared to downstream operations (refining and distribution). The government implemented these specific rules to ensure the sector remains competitive globally while complying with international tax standards. Oil companies operating in the UAE need specialized VAT knowledge to navigate these industry-specific applications effectively.

Many major oil companies in the UAE have established dedicated tax teams just to handle these complex reverse charge scenarios, highlighting how significant these provisions are to their operations.

Ensure compliance with UAE VAT reverse charge mechanism by following all the essential requirements. Know your main obligations, key documentation & implementation steps for effective tax management.